montana sales tax rate 2019

There is 0 additional tax districts that applies to some areas geographically within Missoula. There are no local taxes beyond the state rate.

How Is Tax Liability Calculated Common Tax Questions Answered

Imposition of Tax Imposition And Rate Of Sales Tax And Use Tax -- Exceptions 15-68-102.

. Tax rate of 6 on taxable income between 14301 and 18400. Montana Code Annotated 2019. 25000 x 69 0069 1725.

By Justin Fontaine July 26 2019. Tax rates last updated in April 2022. This is the total of state county and city sales tax rates.

While Montana has no statewide sales tax some municipalities and cities especially large tourist destinations charge their own local sales taxes on most purchases. Non-qualified agricultural land includes parcels of land that are between 20 and 160 acres and are not used primarily for agricultural purposes. MITCHELL BUILDING 125 N.

Montana Department of Revenue. Montana needs to fully overhaul the tax structure and if that involves a sales tax higher income tax a summer tourist tax or legalizing marijuana so be it. Montana limits the amount of Federal taxes which can be deducted to 10000 for a mar- ried couple filingjointly and 5000 for individuals.

The Missoula sales tax rate is NA. Ad Lookup MT Sales Tax Rates By Zip. By William Murphy Senior Editor.

Whitefish Lake Resort Grizzly bears Big Sky Country AvaTax Woodrow F. Remember that zip code boundaries dont always match up with political boundaries like Big Timber or Sweet Grass County so you shouldnt always rely on something as imprecise as zip codes to. Tax rate of 69 on taxable.

The County sales tax rate is. The Department of Revenue works hard to ensure we process everyones return as securely and quickly as possible. Per 15-6-145 MCA the Department of Revenue shall calculate the taxable percentage rate for class 12 property annually by.

Call Avalara Sales Tax Augustus McCrae Lonesome Dove Whitefish Montana Local sales tax Montana Department of Revenue Montana Bozeman Montana Larry McMurtry sales and use tax Resort Tax winter recreation sports. These parcels are appraised as if they were used for grazing and are taxed at seven times the Class 3 tax rate or 1512 percent for 2018. The minimum combined 2022 sales tax rate for Bozeman Montana is.

There are approximately 2695 people living in the Big Timber area. The tax rate is 216 percent for 2018. The local sales tax rate in Capitol Montana is 0 as of April 2022.

Montana Individual Income Tax Resources. While Montana has no statewide sales tax some municipalities and cities especially large tourist destinations charge their own local sales taxes on most purchases. Did South Dakota v.

Sales tax region name. Tax Foundation Facts and Figures 2019 - Table 12 for 2019 2. The Montana state sales tax rate is 0 and the average MT sales tax after local surtaxes is 0.

2019-2020 MONTANA AGRICULTURAL LAND CLASSIFICATION AND VALUATION MANUAL January 1 2019-December 31 2020 STATE OF MONTANA Steve Bullock Governor MONTANA DEPARTMENT OF REVENUE Gene Walborn Director COMPILED BY PROPERTY ASSESSMENT DIVISION Shauna Helfert Administrator SAM W. Montana has no state sales tax and allows local governments to collect a local option sales tax of up to NA. The revised tax year 2019 taxable percentage rate for class 12 property is estimated to be 320.

Montana is one of the five states in the USA that have no state sales tax. There are a total of 73 local tax jurisdictions across the state collecting an average local tax of 0002. The state sales tax rate in Montana is 0000.

Montana charges no sales tax on purchases made in the state. The Bozeman sales tax rate is. 1 A sales tax of the following percentages is imposed on sales of the following property or services.

Click here for a. Calculate your state income tax step by step 6. 2019 Montana Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

The Montana sales tax rate is currently. The Big Timber Montana sales tax rate of NA applies in the zip code 59011. Free Unlimited Searches Try Now.

Montana Constitution as amended in 1972 provides for up to a 4 sales tax. 1725 - 587 1138 tax. The 2018 United States Supreme Court decision in South Dakota v.

Imposition and rate of sales tax and use tax -- exceptions. The bill opens the door with a 25 tax that will go into effect on January 1 2020. Check the 2019 Montana state tax rate and the rules to calculate state income tax 5.

Oregons limit is 6500 Excludes Washingtons BO tax Page 3. Wayfair Inc affect Montana. Montana Department of Revenue.

Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. Your taxable income is 25000. If you want to simplify payroll tax calculations you can download ezPaycheck payroll software which can calculate federal tax state tax Medicare tax Social Security Tax and other taxes for you automatically.

The cities and counties in Montana also do not charge sales tax on general purchases so. In reviewing the history of a sales tax in other states the rate has continually been adjusted upward as infrastructure costs increase. Unfortunately it can take up to 90 days to issue your refund and we may need to ask you to verify your return.

SALES TAX Part 1. Conducting a sales assessment ratio for class 4 commercial and industrial property.

A Small Business Guide To E Commerce Sales Tax The Blueprint

States Without Sales Tax Article

Sales Tax By State Is Saas Taxable Taxjar

Mapsontheweb Infographic Map Map Sales Tax

How Do State And Local Sales Taxes Work Tax Policy Center

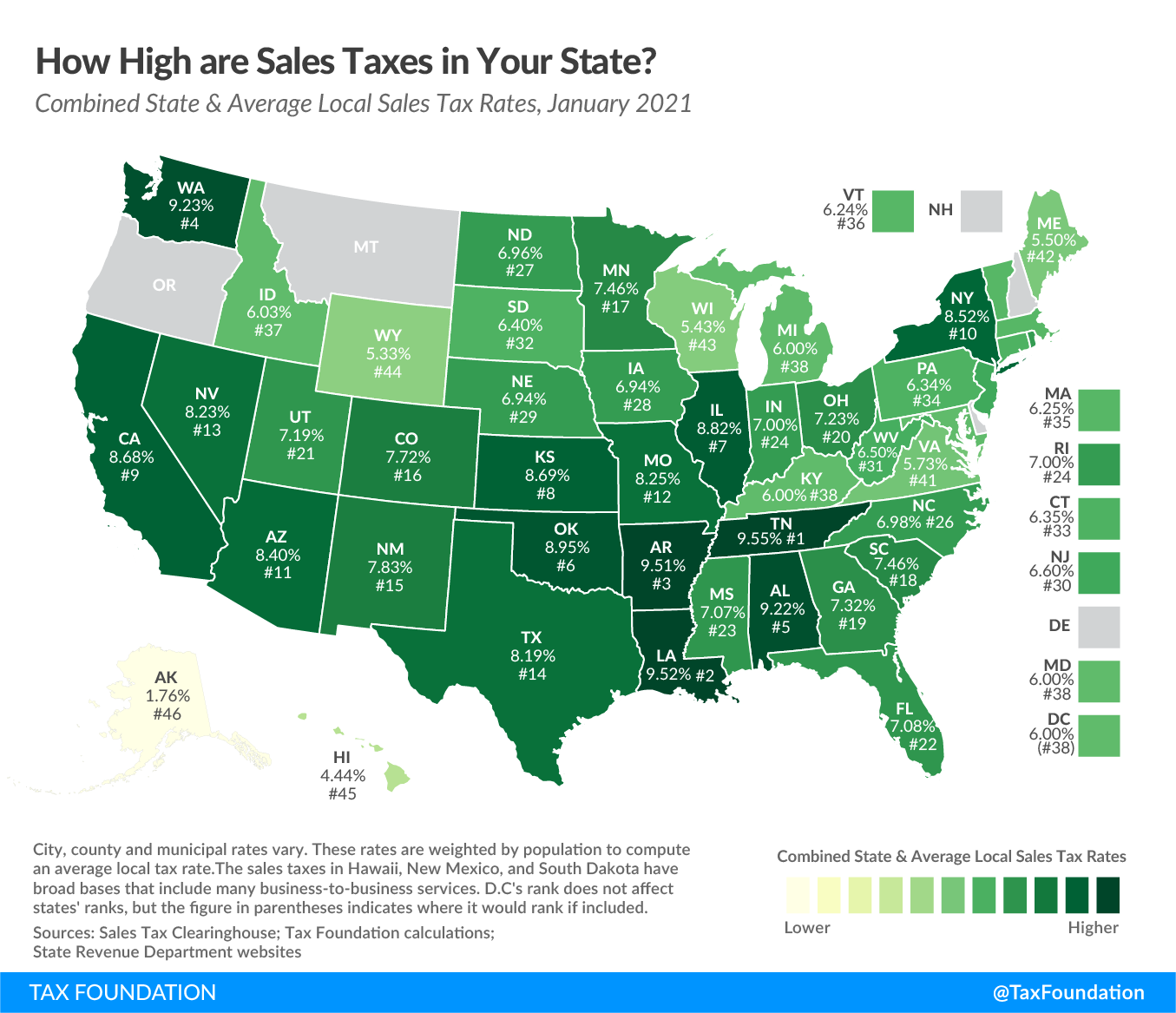

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

States Without Sales Tax Article

How Do State And Local Sales Taxes Work Tax Policy Center

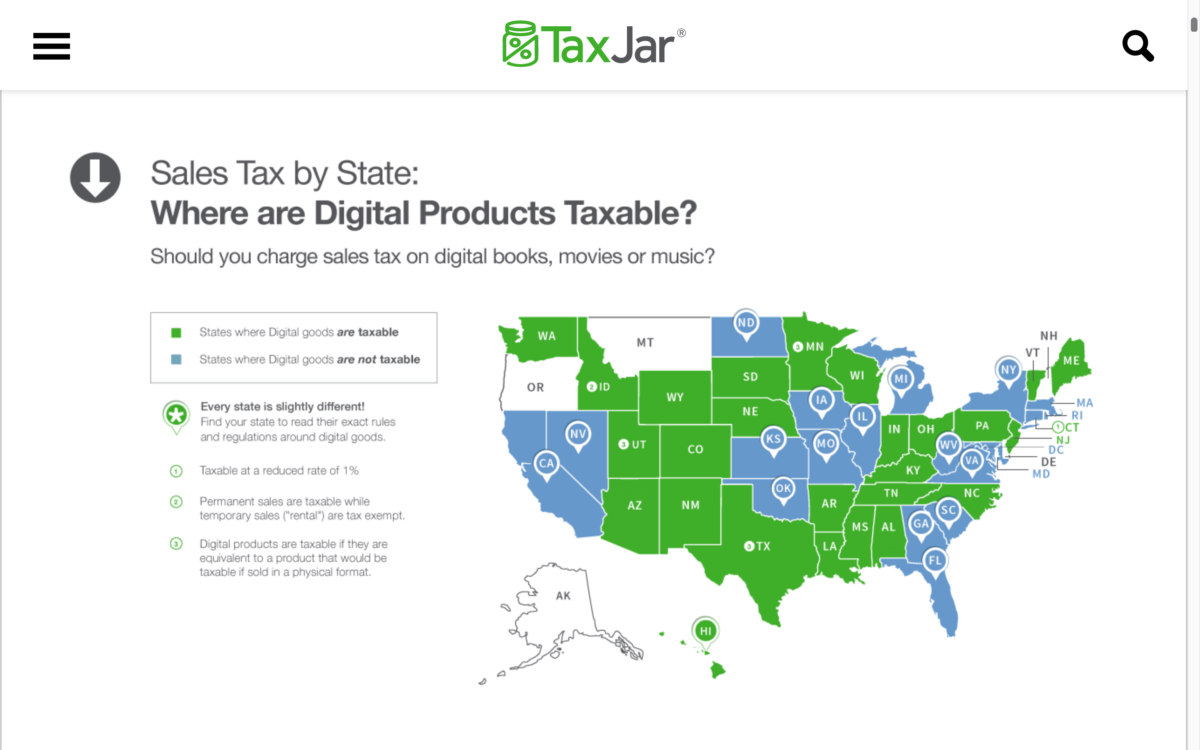

5 Important Tips For Dealing With Digital Product Taxes

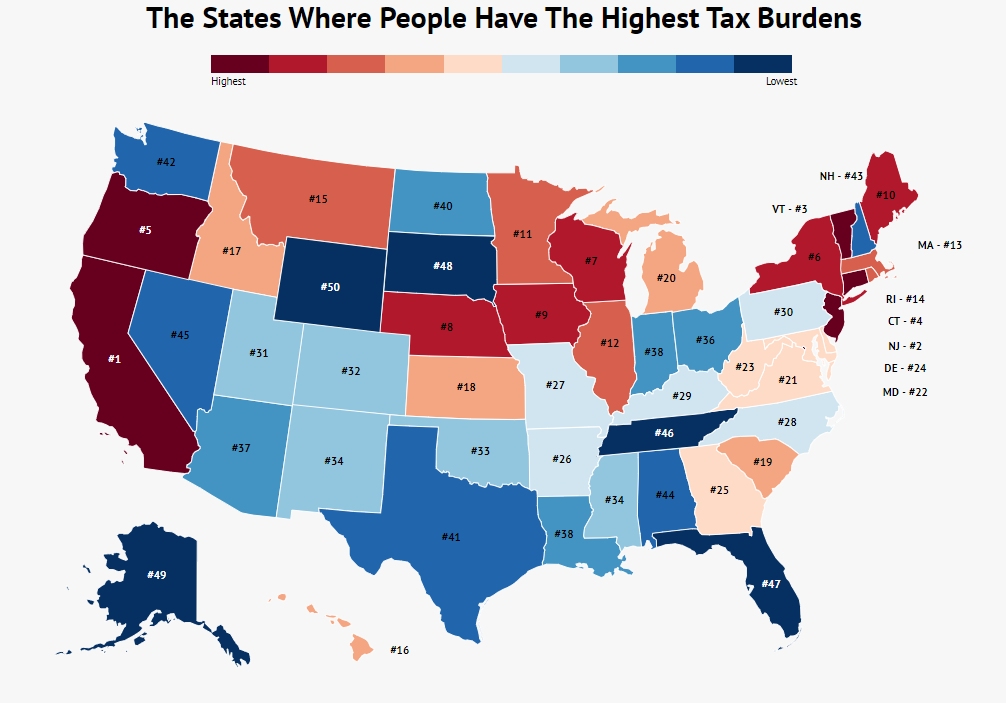

The States Where People Are Burdened With The Highest Taxes Zippia

Sales Tax Definition What Is A Sales Tax Tax Edu

State Corporate Income Tax Rates And Brackets Tax Foundation

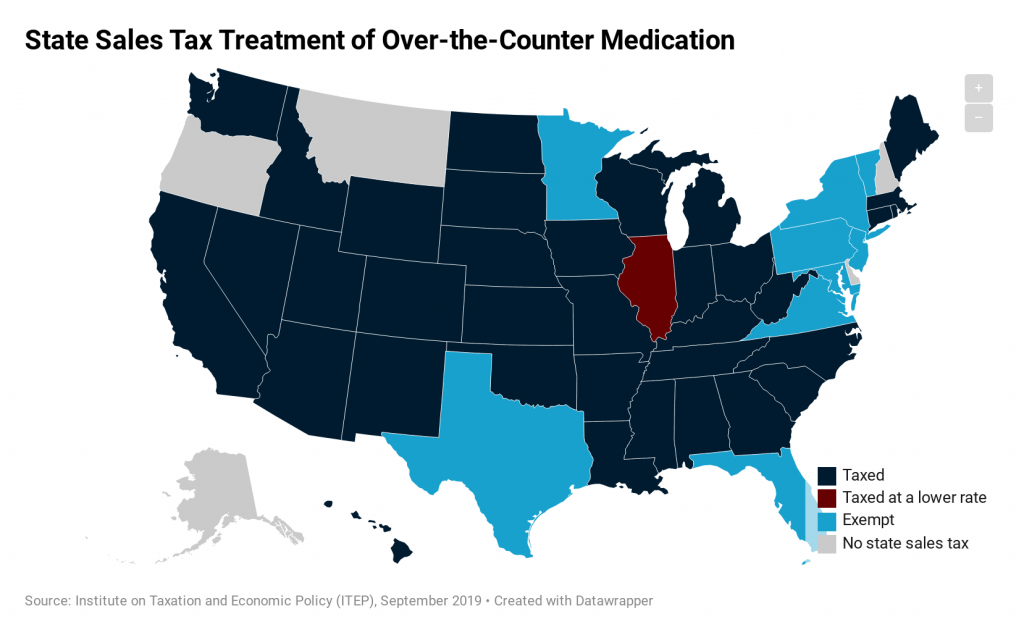

How Do State Tax Sales Of Over The Counter Medication Itep

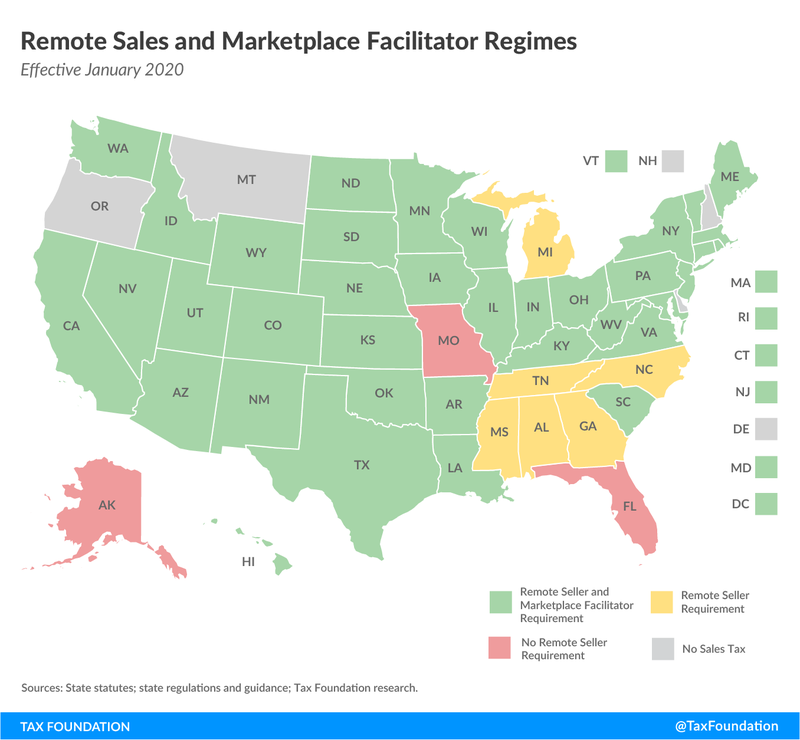

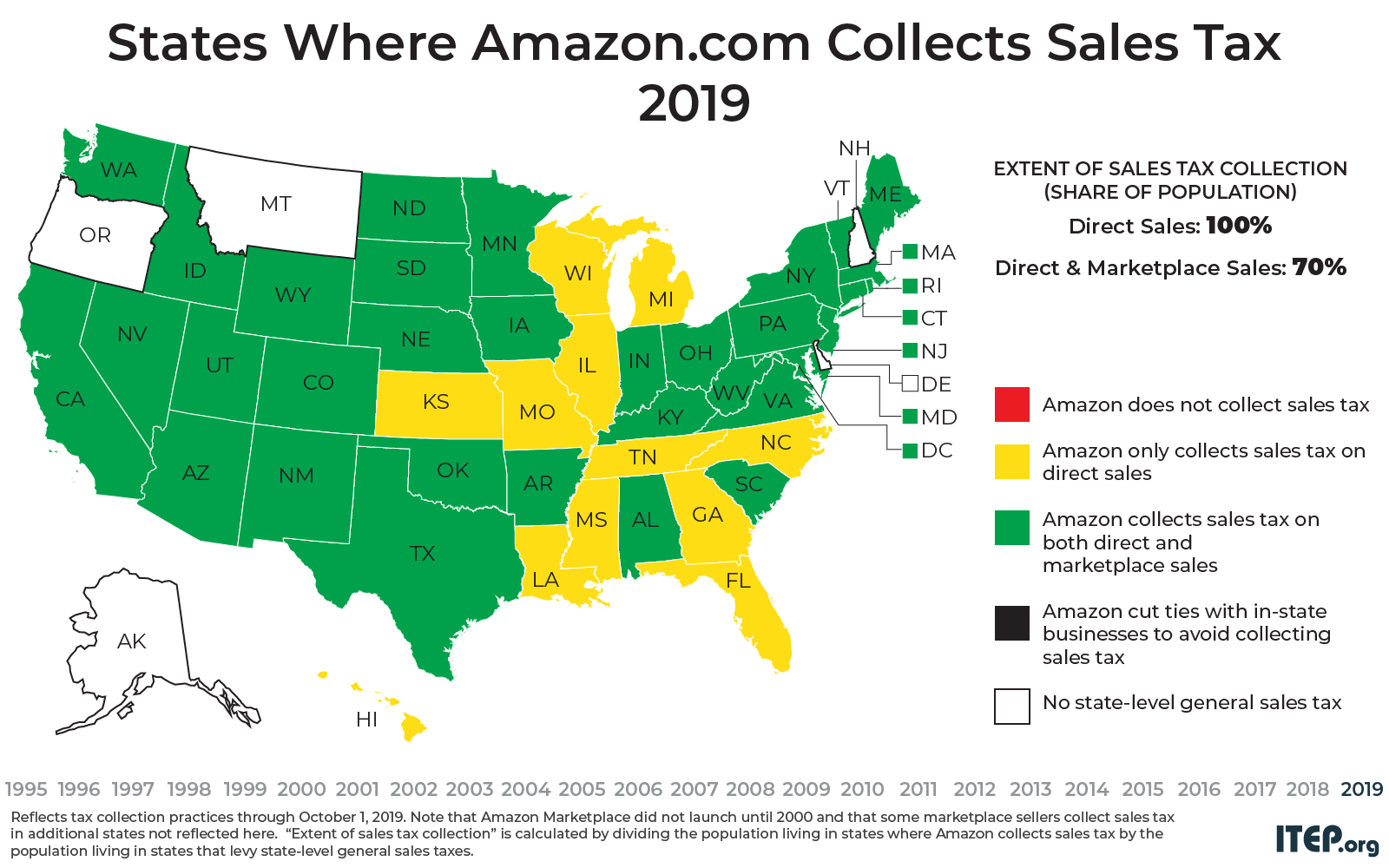

A Lump Of Coal For 12 States Not Collecting Marketplace Sales Taxes This Holiday Season Itep

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

How Is Tax Liability Calculated Common Tax Questions Answered

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)